The purpose of this blog is not to give you a detailed economic explanation of the timber market, after all, we are not economists or any such thing; we just want to show you some relevant facts and figures so that you get a broad idea of what the economic situation of the timber trade is.

So, if you are a wood lover or just curious, read on and we’ll explain to you what’s going on with the production of wood and its derivatives today.

What does the world timber market consist of?

The world timber market comprises the sale of products made from wood by small, medium, and large companies.

It all begins with the process of obtaining wood, whose essential purpose is the extraction of raw wood (freshly felled wood) in order to manufacture all commercial presentations such as:

- Plywood.

- Laminated wood.

- Prefabricated wood (construction).

Likewise, this process requires many technical efforts, allowing the production of goods derived from wood such as:

- Paper pulp.

- Extraction of oils and resins to be used in the production of natural solvents (many used to treat other woods).

However, at the same time, finished products are also made from wood, such as:

- Boxes.

- Fences.

- Posts.

Market segmentation in the timber industry

In the same way, wood products are grouped into 3 main groups.

1. Wood by type

This group includes all wood products used in different segments of the market. Some examples are:

- Joinery products (chairs, tables, beds, desks, etc.).

- Handicrafts.

- Wood for construction.

- Wood for combustion.

- General carpentry.

- Manufacture of musical instruments.

2. Wood by application

Broadly speaking, there are 2 types of wood applications: wood for residential purposes and wood for commercial purposes.

Residential timber (retail)

Timber that is distributed to small businesses or privates, for example, a carpenter who needs to buy a small number of wood panels (10 units or less) to build various products.

Timber for commercial purposes (wholesale)

This covers the production of timber in large quantities to be sold to large distributors. Timber by distribution method

3. Timber by distribution channel

Online channel (internet)

This channel is mainly used in the international timber trade, although it is also used for domestic trade in some countries in Europe, Asia, and North America.

In Latin America, it does not yet have such a strong presence, although it is expected to grow in the coming years.

Offline channel (face-to-face)

This is the preferred channel in Latin America and Africa; however, during the pandemic, it reported lower growth figures (as was to be expected) due to mobility and trade restrictions.

Economic outlook for the timber industry before, during and after COVID-19

Economic outlook of the timber industry before the pandemic

Based on data from the Food and Agriculture Organization of the United Nations (FAO), by the end of 2018, there was a 1% increase in wood-based panel manufacturing and 5% increase in plywood production in markets in:

- The Asia-Pacific region.

- The North American region.

- The European region.

FAO states that this increase in the manufacture of wood products could be explained because during the same year these geographic regions experienced economic growth as well.

Similarly, FAO states in its report that derived products such as paper pulp declined by 1.5%, especially because of the tendency of higher consumption of digital content, which has decreased the use of paper.

In addition, the production of laminated wood increased by 5%, resulting in a total record production of 2,030 million cubic meters.

Similarly, total marketing at year-end 2018 had an increase of 7% or 138 million cubic meters of which 43% was imported by China.

In general terms, the production of all commercial presentations of wood increased considerably during the 2 years prior to the onset of the COVID-19 pandemic.

However, Canada was not as fortunate, and due to the tariff hike policies of the United States (Canada’s main export market), the Canadian market suffered a decline in production and thus a contraction in the export of wood products.

The latter allowed the Russian Federation to become the world’s leading exporter of lumber up to that time.

On the other hand, China was the “big winner” in the years leading up to the COVID-19 pandemic.

It moved from being one of the world’s leading consumers of wood-based panels to one of the world’s leading producers.

In addition, China surpassed the United States in the production and export of lumber.

Another noticeable change during the pre-pandemic era was the dramatic growth of the pellet industry, small portions of compressed plant matter (such as wood) used as fuel.

This growth in pellet production is explained by the increased demand for bioenergy fuel alternatives from the European Union.

Pellet production grew by 11% resulting in 37 million tons. Keep in mind that the expected production at that time was 24 million tons.

The pellet market was dominated by Europe with 55% of world production, which was expected given that Europe had the highest demand.

Also, pellet production in the Asia-Pacific region doubled from 7.5% in 2014 to 15% in 2018; this tendency of growth in Asian production is explainable because countries such as South Korea and Japan greatly increased the demand for pellets around the same time.

In summary, it is wise to say that the wood economic sector was booming in all market segments until the first quarter of 2020 when the pandemic started.

Wood Industry Economic Outlook 2020-2021 (The Worst of the Pandemic)

The COVID-19 outbreak was a major impediment to wood products manufacturing, as it created many trade restrictions in both raw materials and finished products, meaning that the supply chain was affected.

This led to a sharp drop in the consumption of wood goods on a global scale.

Quarantines and trade restrictions caused an economic contraction in the entire timber sector, especially in South America and Africa, where it is suspected that the illegal timber trade increased.

Given this situation, it is expected that the market tendency will ideally adjust to the current environmental situation of the planet.

This is why companies are implementing better tracking systems to have transparent records of the origin of the timber they sell and thus ensure that they are not trading in illegal timber.

The Asia-Pacific region showed the strongest growth in wood products manufacturing during 2021, indicating that the pandemic did not affect Asia’s timber sector as significantly.

North America was the second-largest producing region in the timber market, although it did register a decline in sales, imports, and exports.

However, since the end of 2021, there has been an increase in demand for wood products.

2022-? War in Ukraine and the impact on world trade

What was to be expected in 2022?

According to research prepared by The Business Research Company, the global timber market was expected to increase its annual profits from $631.11 million in 2021 to $684.26 million in 2022.

In addition, researchers anticipated that the market would reach annual profits of $903.33 million by 2026.

This data was based on estimates suggesting that the timber market would grow steadily after the global economic downturn brought on by the COVID-19 Pandemic.

Additionally, the expectation was to see growth more pronounced in the U.S. timber sector and especially in the established markets, and less so in the emerging markets.

In fact, according to data from the International Monetary Fund (IMF) global gross domestic product reached 3.3% growth in 2021.

Then, the IMF suggested that prices of wood-based products could recover, which could generate greater public and private investment in this economic sector.

Therefore, the economic momentum of the timber sector was expected to remain upward over the next 5 years.

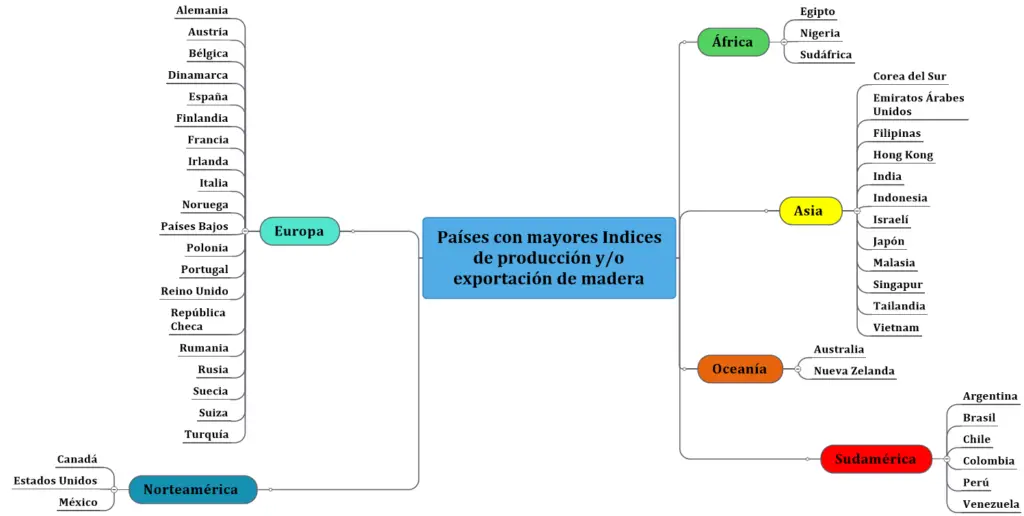

Other regions included in the study were Western Europe, Eastern Europe, South America, the Middle East, and Africa. Similarly, the countries sampled for the study were organized by continent as follows:

Unfortunately, no one was counting on the outbreak of the war in Ukraine and the implications it would have on the world economy.

The start of the war in Ukraine

In February 2022, Russian troops invaded eastern Ukraine starting an occupation that has already been going on for 3 months (May 2022).

This occupation has left thousands dead, tens of thousands wounded and millions displaced, which is a tragedy in every sense of the word.

But not only Ukraine has been affected by this occupation. In fact, the whole world has felt the consequences of the war through the economic implications that have not been long coming.

Let us remember that Ukraine and Russia are two of the world’s main exporters of fertilizers and raw materials.

The manufacturing capacity of Ukraine and especially of Russia is such that the rest of the world depends on many of these raw materials and, given the stoppage of exports, the prices of the entire supply chain have risen as the war has progressed.

Moreover, at least for the time being, no one except Russia and Ukraine has the capacity to supply the world’s demand for these raw materials.

And how does this affect the timber industry?

Since the last quarter of 2021, there has been a considerable increase in global demand for timber.

This has caused wood prices to “go through the roof”, especially in the softwood market (Pine and Spruce among others) which are the most used woods in the world, having many applications.

So, Sweden and Finland have emerged as a possible alternative for supplying the market of wood that is no longer being exported from Russia.

But, it is known that the Nordic countries cannot match the production coming from Eastern Europe.

Moreover, while the Nordic countries have started to trade these timbers, they have not been very clear on what the prices will be or when they might deliver.

On the other hand, a similar situation is occurring in the hardwood market in terms of prices, as the tendency is also upward, especially in the Western European region where woods such as oak are scarce.

The same happens with tropical woods from Africa and Brazil (the most expensive of all as they are the most exotic), as prices are only increasing.

In contrast, prefabricated or synthetic woods have increased in world production, probably as a measure to counteract the shortage of natural woods.

Factors affecting the production of wood products

Timber producers are concerned that the current supply is not able to meet the growing demand. And what may seem like a win-win situation for timber entrepreneurs may in fact turn into a headache.

This is because the war in Ukraine may aggravate this situation, as trade is restricted.

Then the problem of low supply is joined by rising prices of raw materials, such as fertilizers, pesticides, and fertilizers, all of which are Ukrainian and Russian export products.

On the one hand, then, we find that Ukraine cannot export its products because it is destroyed.

While, on the other, there is no trade with Russia because of the economic sanctions imposed on it by the UN, the European Union and the United States, to which Russia has responded with a series of counter-sanctions that make the situation even more difficult.

For example, even if a country in Europe wanted to trade with the Russian government, it would have to do so on Russia’s terms, since after all, they have no need for the timber.

The timber industry in Eastern Europe before the war

Timber exports from Russia and Ukraine to the European Union exceeded €2.5 billion per year by the end of 2021.

The main timber exported by these 2 countries (Russia in particular) was coniferous wood and products derived from them, such as:

- Plywood.

- Laminated wood.

- Paper pulp.

- Wood for charcoal production.

The countries with the highest imports of wood from Russia and Ukraine were Germany, Estonia, Finland, and Poland. These imports totaled more than 100 million euros.

However, at present, the various political-economic sanctions applied to Russia and Ukraine’s inability to trade have indefinitely closed off the trade route with Eastern Europe.

In fact, new economic sanctions against Russia have been imposed since the beginning of 2022, and the Russian government has responded by banning exports of raw timber to the European Union and increasing the costs for European Union countries wishing to import sawn timber.

As a result, the low lumber supply worsened in the first quarter of 2022.

The energy crisis in Europe could worsen the timber situation

The truth is that Europe is going through a difficult situation when it comes to energy, as a good part of the continent (if not all of it) is heavily dependent on the supply of gas and oil coming from the Russian Federation.

In fact, some are already saying that, if the situation continues the same, Europe will have to use part of its wood reserves to produce coal as a source of energy, which would be an environmental setback for the old continent and would also further worsen the wood deficit.

In any case, the only way out of this complex situation is the sustainable use of Europe’s wood reserves or the situation could get even worse.

What is happening in the world market?

There is one constant in today’s wood market: shortages.

Examples of this can be seen in the sectors producing products such as pellets, boxes and coffins, as some companies have even had to completely stop production due to a lack of raw materials coming from Eastern Europe.

Entrepreneurs around the world have not been able to recover from the economic and social devastation caused by COVID-19 and now, in 2022, they must worry about the lack of basic supplies to boost their economic sector.

Moreover, shortages are not only seen in the timber sector but in every economic market across the globe.

Keep in mind that in a situation like the current one where oil prices are sky-high on account of the withdrawal of Russian fuel from the market, it is to be expected that the costs of all oil derivatives will also increase.

Therefore, all costs in the timber production chain are going to increase. Even if you want to harvest your own timber reserves, you must first ask yourself how many of the forestry machines work. The answer is: gasoline or other petroleum derivatives, which are on the rise and seemingly will only continue to rise.

In other words, the situation of the timber market today is worse than during the pandemic because at least then the timber sector didn’t experience a total stoppage in production as it is happening now due to the war.

In addition, the economic crisis affects not only Europe but the rest of the world because utilities everywhere have increased in price and the wood industry consumes a lot of energy, especially electricity, and this has increased the industry’s operating expenses.

All of the above explains how the operating costs of the timber sector have increased, which ultimately increases the final value of the finished products.

Unfortunately, the effects of the war have been so severe and unthinkable that countries like Spain, in addition to all the problems we have mentioned, find that many of their truck drivers are of Ukrainian nationality.

And as you have surely seen in the news, Ukrainian men are returning to their country to defend it, so in Spain, there is also a shortage of drivers, which directly affects the transportation of timber.

What is the future of the timber industry?

It is difficult to know how the situation is going to develop in the timber market. In fact, no one can say for sure what will happen to the economy overall.

However, it is certain that there must be fundamental changes in timber production, which must be focused on sustainable cultivation.

But that is not enough, since the timber industry must look for alternatives to oil derivatives as this is a market on which many sectors depend, and, as we have already seen, it can change at any time.